Menu

-

DATA MATURITY SURVEY ANALYSIS

Last year’s MarTech Maturity Survey provided critical insights and focus areas for different industries to improve their maturity along 6 different dimensions – Customer Strategy, Data Maturity, Analytics Maturity, Campaign Maturity, Digital Maturity and Technology Maturity. A strong data ecosystem is a critical foundation for MarTech maturity. In this year’s survey, the focus was to assess the Data Maturity of various industries and identify improvement areas. The survey covered diverse facets around data like data strategy, data unification approach, consumption of data for decision making, type of analytics (Descriptive, Prescriptive, and Predictive), ROI measurement and data governance. The objective was to identify the overall data maturity of various industries as well as identify some of the emerging trends as well as roadblocks to data adoption. The participants included professionals at different levels (CEO/Founders, CMOs, senior and mid-level marketing as well as data professionals) from various industries like E-commerce, Financial services, Retail, Technology, Automobile, Media & Entertainment and Consulting set-ups.

Duration of the survey: Mar - Apr 2022

Respondents: CEOs, Senior and Mid-level Marketing Professionals, Senior and Mid-level Data Professionals

-

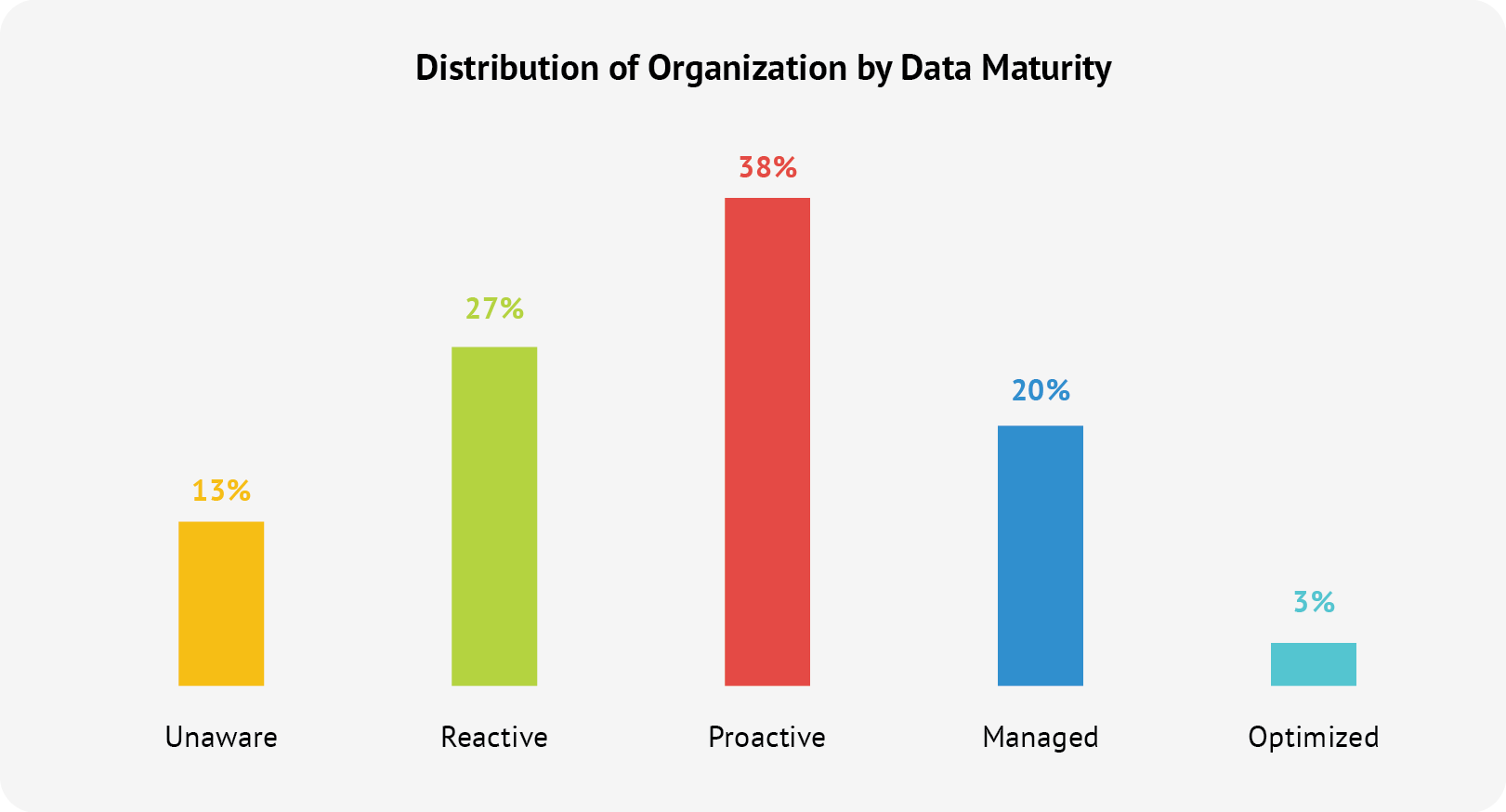

Majority of the organizations fall under the “Proactive” category.

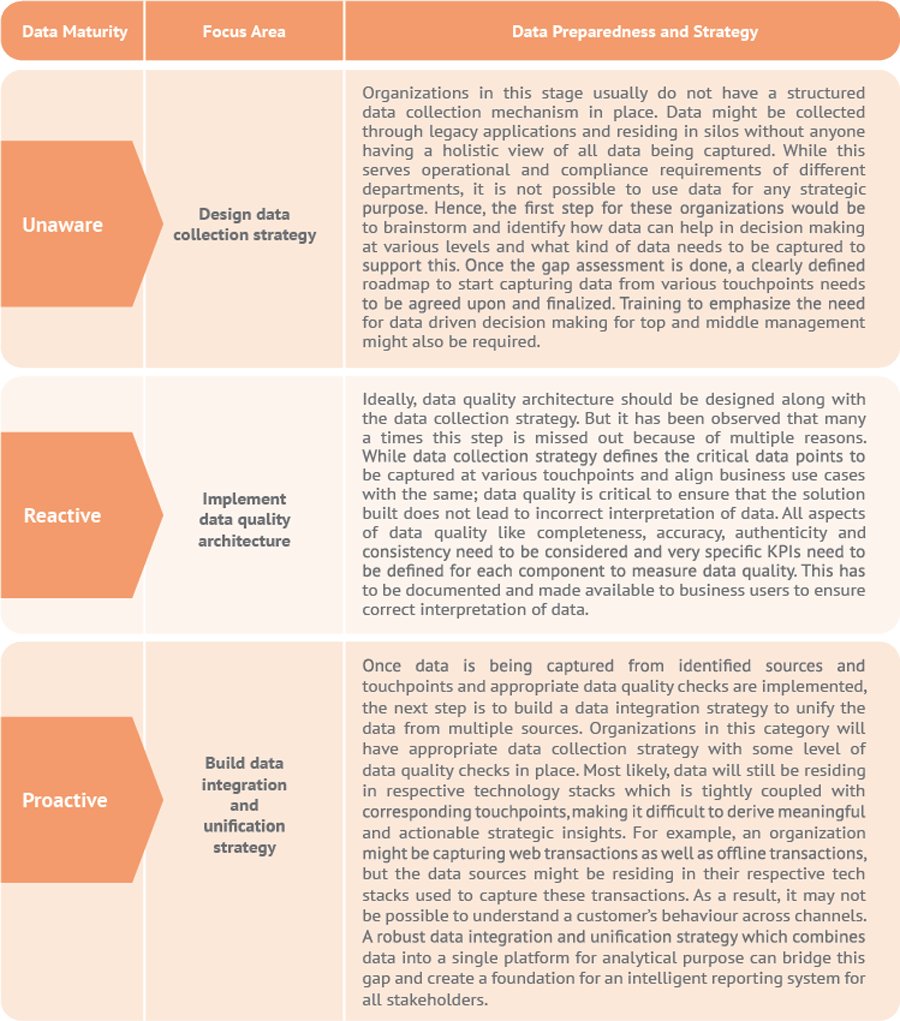

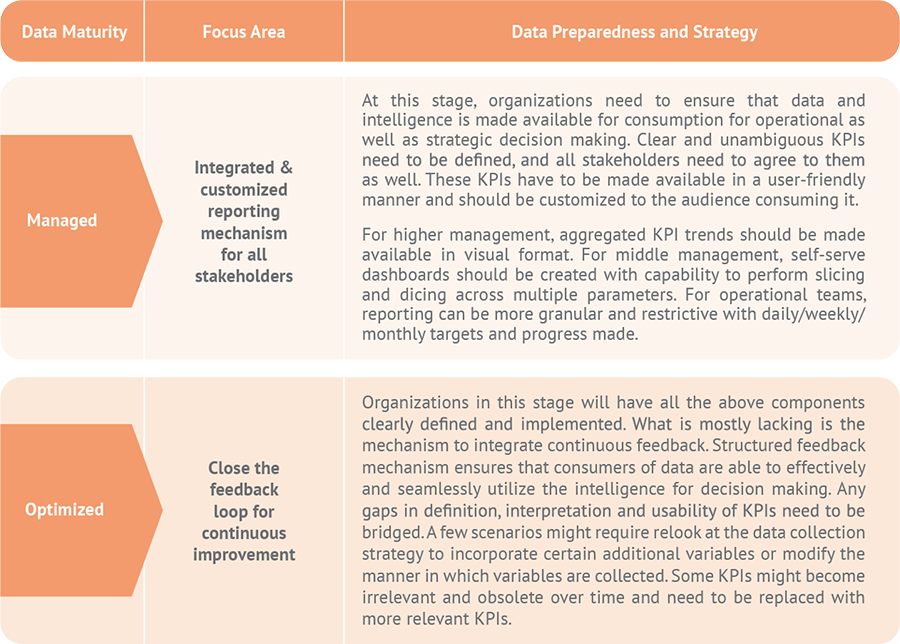

Around 13% of the organizations come under the ‘Unaware’ category, which is the initial nascent stage. These organizations use data only for operational or compliance purposes and need to brainstorm & revise their data collection strategy so that their data can be used for strategic purposes and decision-making. 27% of the organizations come under the ‘Reactive’ category, which means that, while they might have a proper data collection strategy in place, they now must focus on implementing a data quality architecture. All aspects of data quality like completeness, accuracy, authenticity and consistency need to be considered and very specific KPIs need to be defined for each component to measure

data quality which will ensure that the data is being interpreted correctly. Majority of the organizations come under the ‘Proactive’ category. One of the most challenging tasks at this stage is unifying & integrating data from various standalone applications and creating an omnichannel view of their business which can create a strong foundation for an intelligent reporting system for all stakeholders. Only about 3% of the organizations are at the ‘Optimized’ level. Organizations in this stage will have all above components clearly defined and implemented and the focus is on continuous improvement.

-

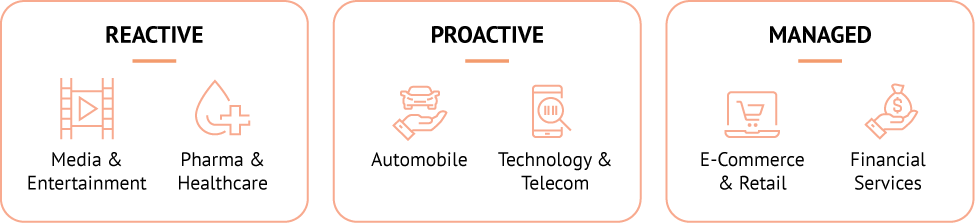

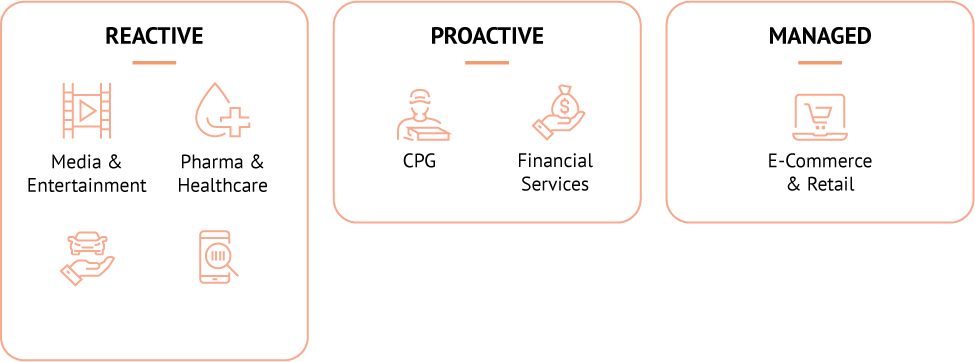

Industry wise trends

While none of the industries can be categorized as completely data-driven, Finance & E-Commerce/Retail industries have the most mature practices when it comes to data governance. The Auto, Pharma & Media industries still have a way to go which is understandable, since these industries have been operating in the offline space for a long time and thus might face challenges in integrating data from all sources. A significant source of information for the Media & Entertainment industry

would be the unstructured data from social media likes, dislikes & comments, website traffic or streaming data on digital platforms which is difficult to track and integrate with the structured data.

When it comes to Measurement & Tracking, E-Commerce is ahead in the race with mature processes for experimentation and tracking of key metrices.

Data Governance:

Measurement & Tracking:

-

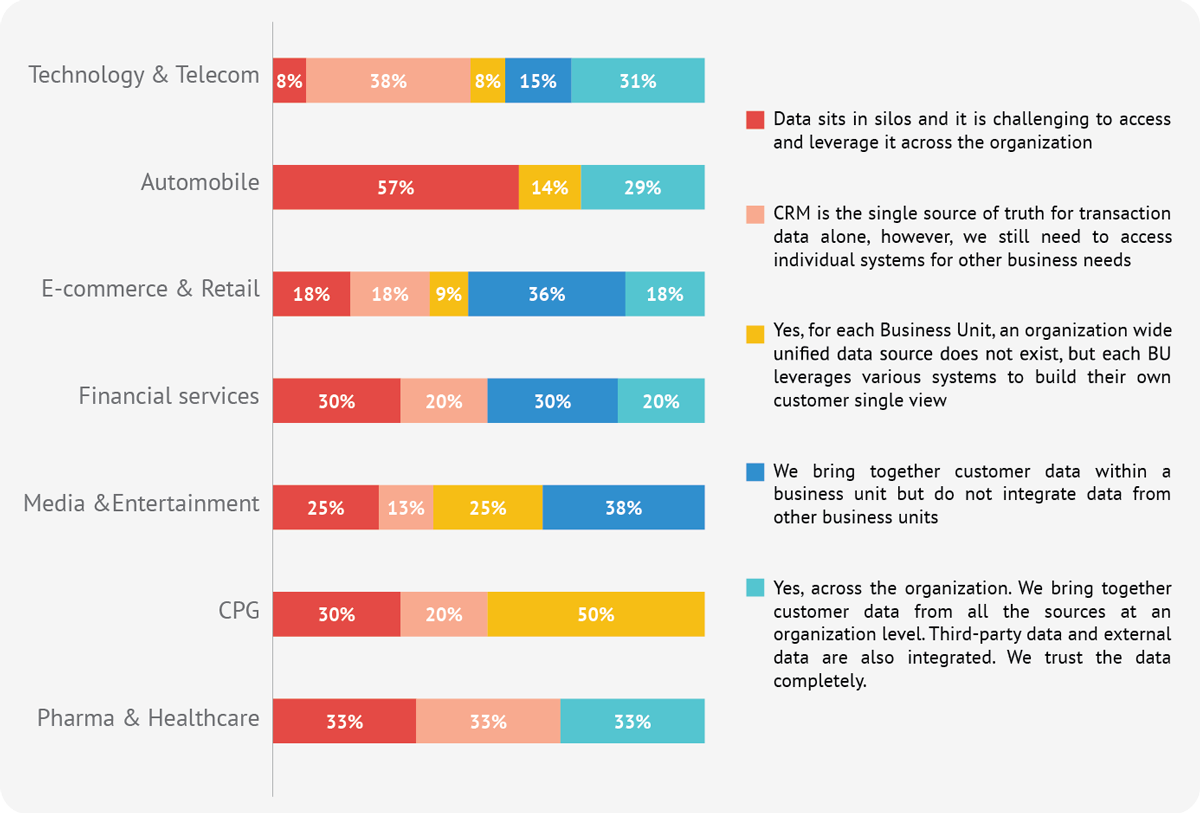

Do you have a unified source of data/a single version of truth for your customers across all your businesses?

Over time, almost all industries have understood the need of having a unified data of customers, captured across different touchpoints. This ensures data consumption for strategic and tactical decision making beyond operational activities. However, few of the industries are yet to catch-up as far as implementation is concerned. Many organizations admitted that their data still resides in silos and they are facing challenges

in accesses & leveraging it across the organization. The Auto, CPG and Pharma industries are lagging significantly compared to their counterparts in Financial Services and E-commerce. Some of it can be attributed to inherent challenges of the industry (complexity and feasibility of data capture process, legacy applications deployed at various touchpoints, alignment of various stakeholders etc.)

-

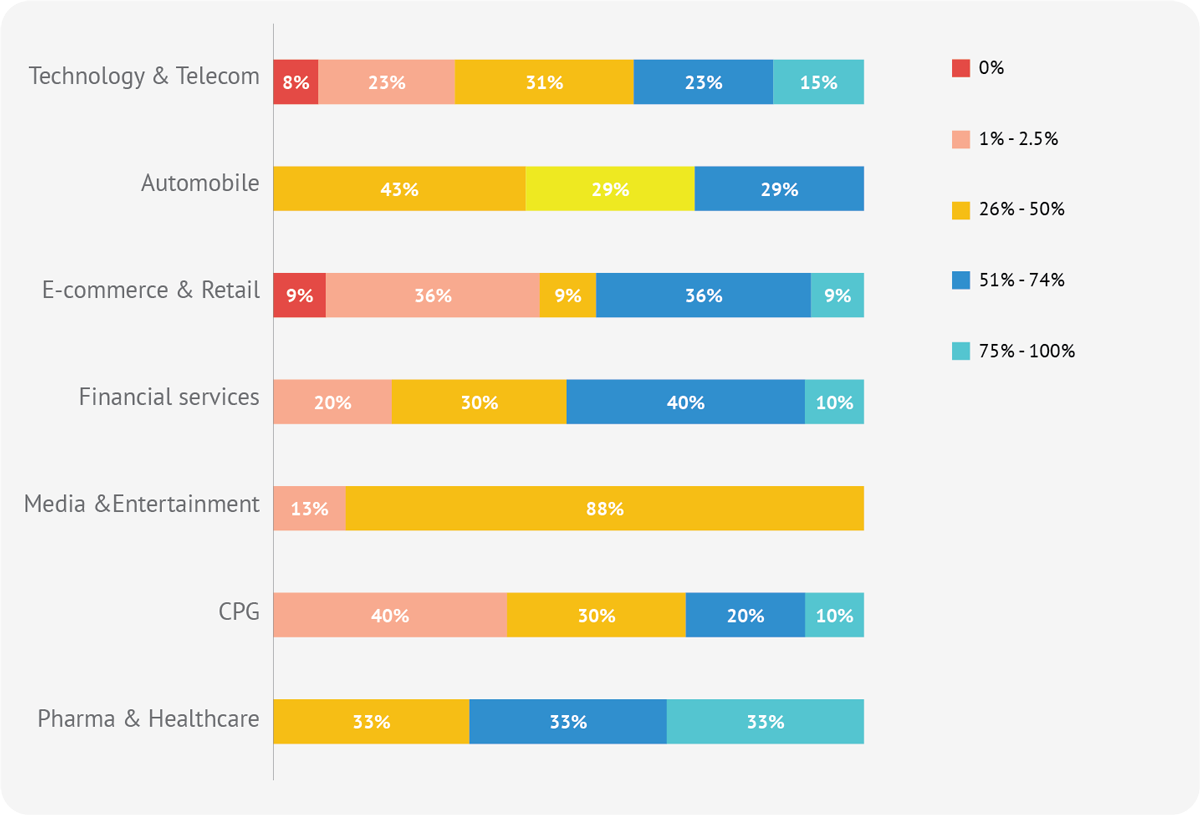

What percentage of customer data from different sources is integrated together?

Having 100% data aggregated into single system is yet far-fetched goal for majority of the organizations. Most of the organizations have 25% to 75% data aggregated in unified datamart. While in some organizations this is a result of a number and the complexity of data sources, many organizations lack the clarity of how unified data can help in improving connected customer experience.

While technology has made data integration, processing and storage much more seamless, lack of direction to map the benefits of unified datamart for strategic and operational decision making, is the driving factor for this gap. The financial services sector is leading in this area (partly due to regulatory requirements).

-

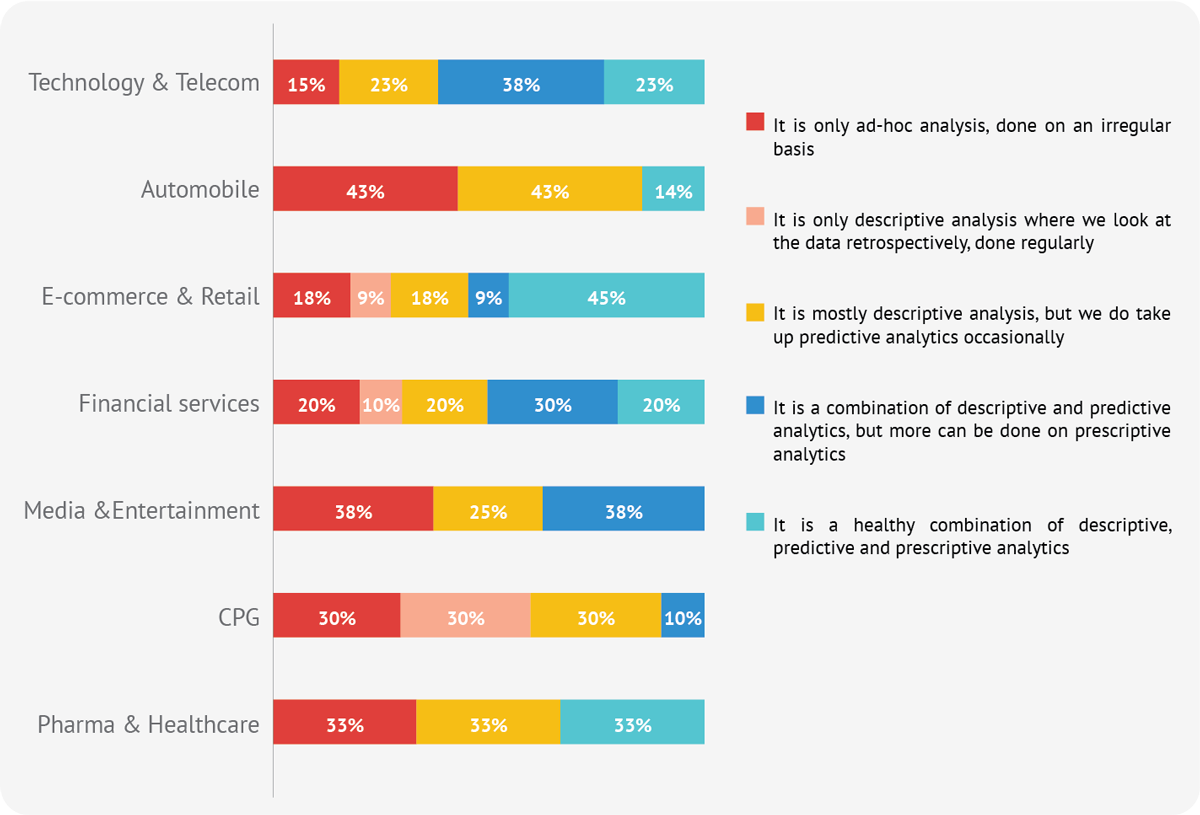

What are the different kinds of analysis done on the data?

Relevance, depth & frequency of analysis done on data depends primarily upon two parameters: clearly defined use cases and data availability in consumable format. Some organizations have mature data integration strategy in place but do not consume data for structured predictive & prescriptive analytics mainly because they do not have data driven use cases defined. Once the business use cases are defined, and data is integrated into data mart, it is necessary to have an optimal

data structure in place for descriptive, predictive & prescriptive analysis. While descriptive analytics has become hygiene in most industries, E-Commerce, Financial services and Telecom are much ahead as far as implementation of predictive & prescriptive analytics is concerned. Though lot of descriptive as well as predictive analytics happens in other industries, it is more ad-hoc in nature.

-

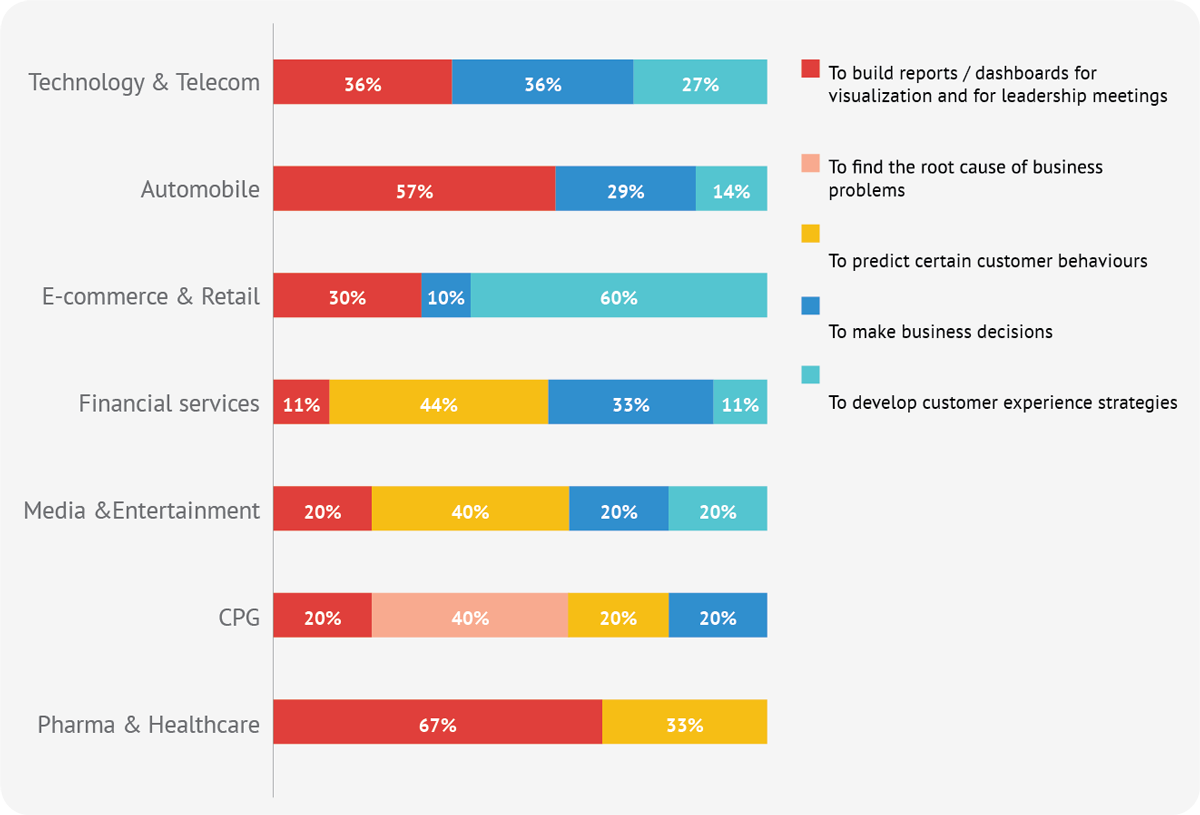

What is the most common use of analytics in your organization?

For many organizations across industries, data is only being used to build impromptu reports or dashboards for business meetings. E-Commerce is the only sector using advanced analytics with the primary goal of improving the customer experience.

-

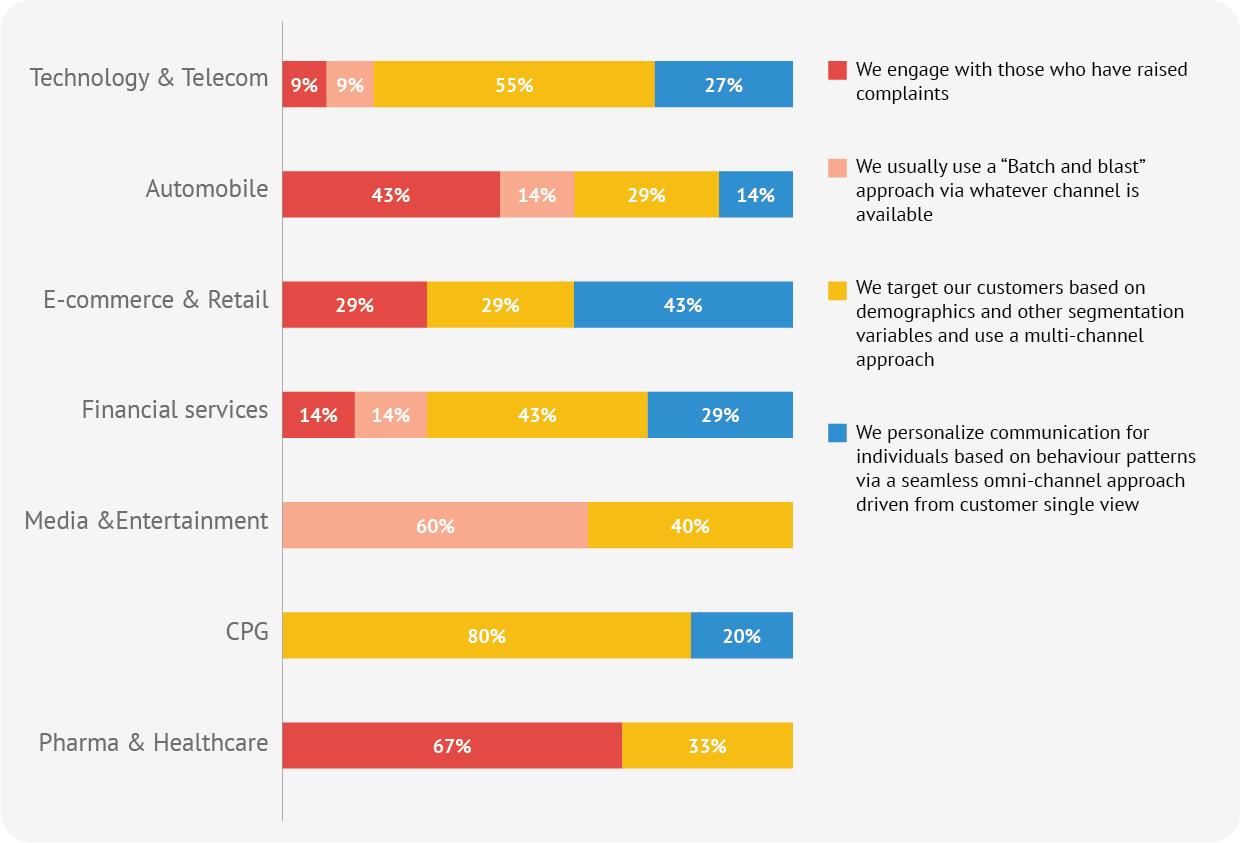

How would you describe your interactions with your customers?

Challenges faced in integrating, segmenting & analyzing customer data across all sources prevent many organizations from being proactive as far as customer interaction is concerned. A large portion of E-Commerce companies have succeeded in providing their customers

a personalized experience by implementing an omnichannel approach. In most other industries, companies are able to respond only when a customer raises a complaint as they do not have data captured across all the touchpoints integrated in the unified platform.

-

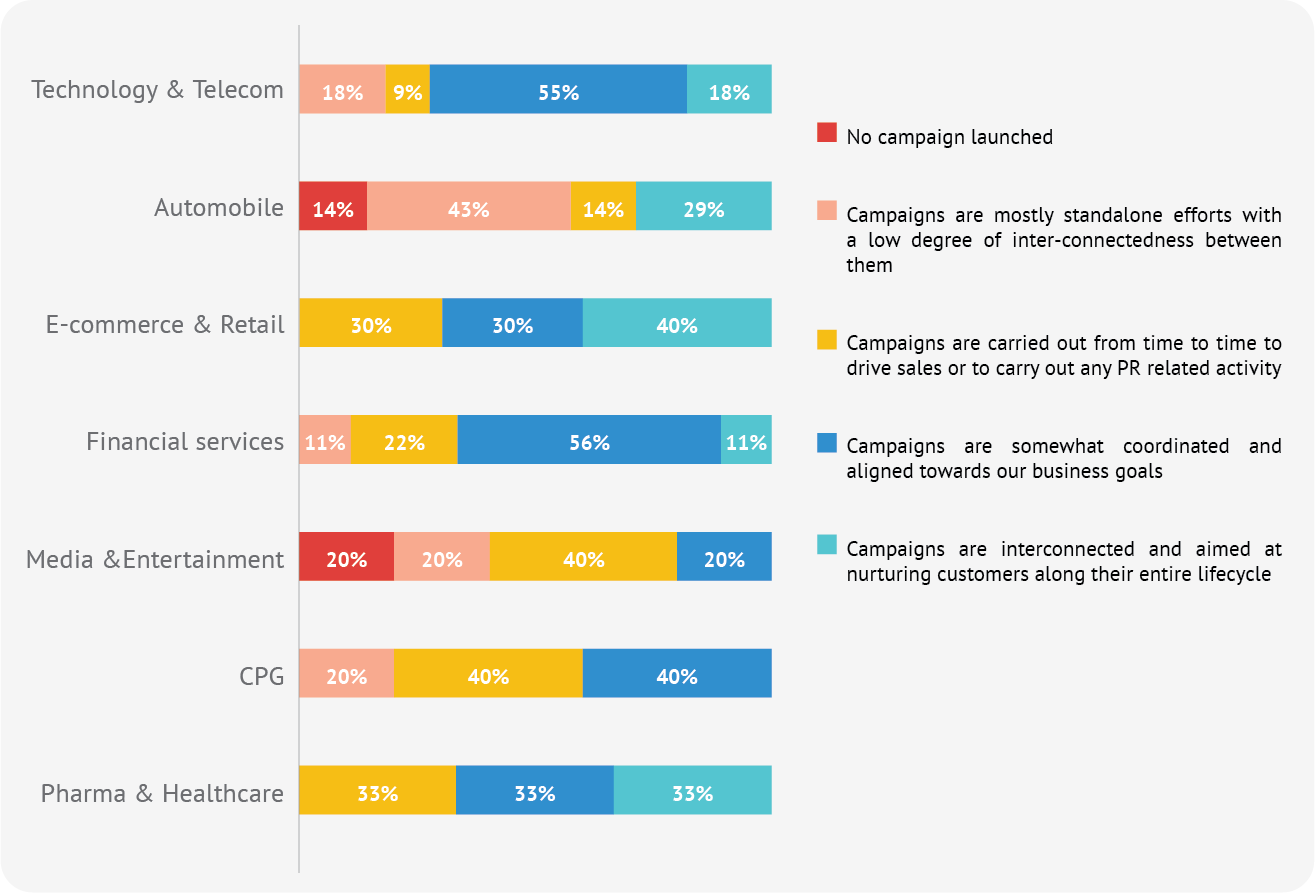

Which statement best describes the degree of co-ordination across your marketing campaigns?

It is essential that all marketing efforts are aligned towards improving overall connected customer experience rather than isolated and ad-hoc targeting to meet specific operational needs. Lack of this results in sub-optimal brand positioning as a message to the

customer is not consistent. Majority of the Financial services & E-Commerce organizations have aligned their marketing campaigns towards strategic business goals and improving overall customer experience.

-

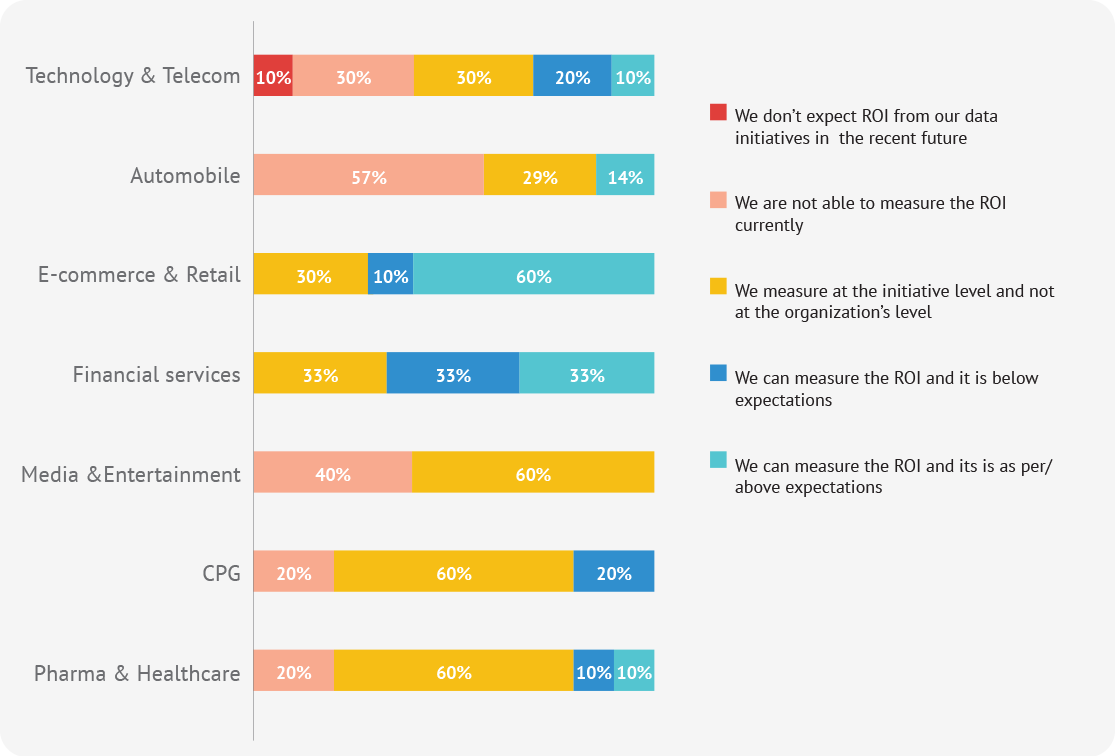

Are you able to realize ROI from data driven initiatives at your organization?

Ensuring that appropriate framework for ROI measurement is defined and relevant KPIs are agreed by all stakeholders is a prerequisite for a robust campaign strategy. Many organizations struggle with ROI measurement as they do not have clear and unambiguous KPIs in place. Many others are still experimenting with their marketing attribution logic.

Obtaining a high ROI will require a robust targeting strategy in place which includes the right combination of channel, product & timing. Majority of the organizations in Media & Entertainment and Pharma industries are still figuring out their attribution logic and how to improve their RoI.

-

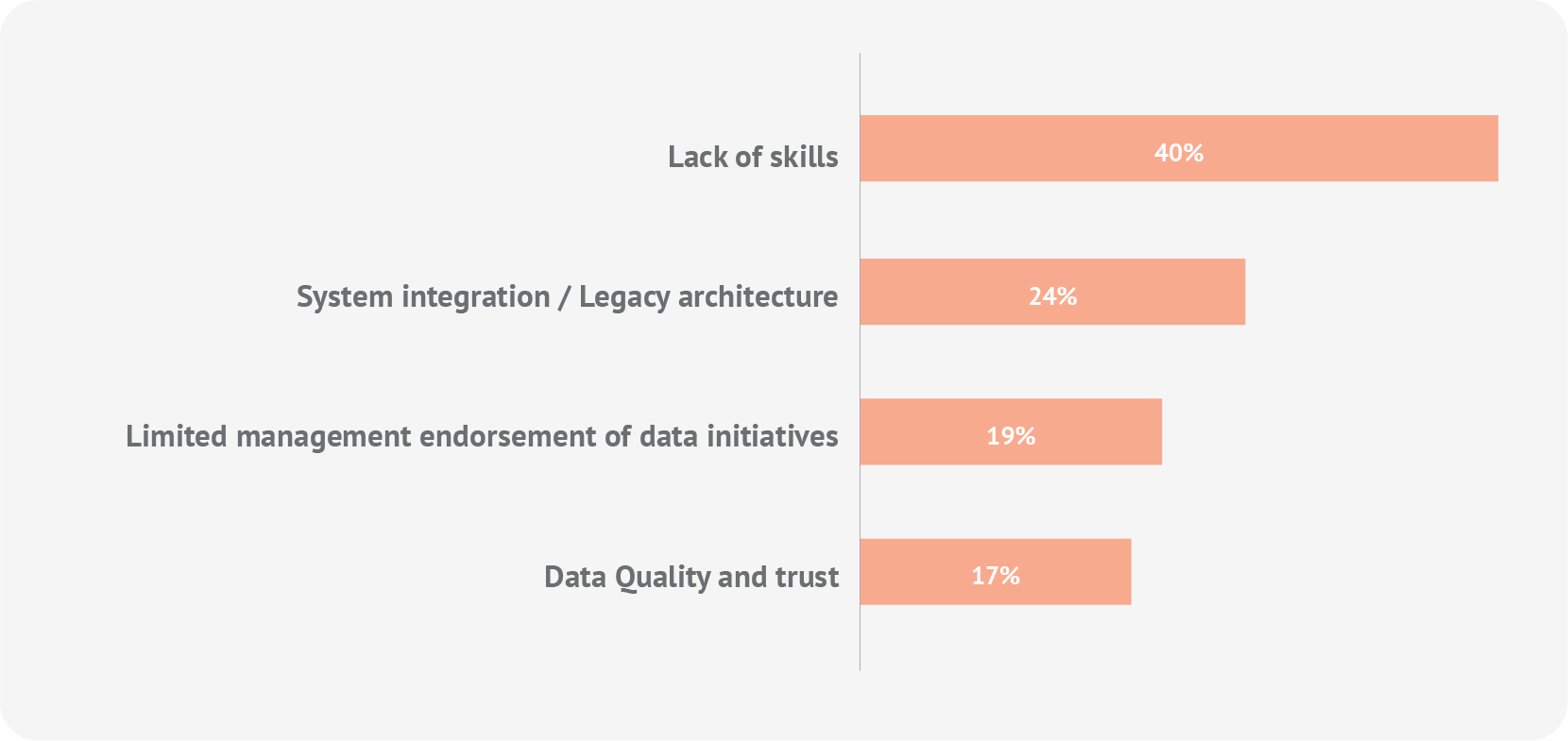

What are the challenges to data adoption?

Lack of skills & legacy architecture are seen as the topmost challenges to data adoption across all industries. Migrating from old & obsolete systems to newer technologies can be a tedious, time-consuming

activity, and might end up disrupting daily tasks which makes organizations hesitant to adopt to the new ones. This also requires the employees to be constantly trained with the newest skills.

Conclusion:

Though organizations have realized the importance of unified data platforms to drive customer experience, gaps remain in multiple areas including comprehensive coverage of data sources, customized reporting platforms for different stakeholders, and unambiguous ROI definition & tracking. As far as overall data maturity is concerned, Financial Services and E-commerce organizations are at a much advanced stage as majority of them have at least 50% data unified in one common environment. These organizations need to continuously strive towards integrating and unifying remaining sources and ensuring that optimal platforms are

available for consuming the intelligence for various use cases. Other industries need to focus more on data capturing and unification strategy of critical sources. Across industries, there is a need to educate all stakeholders about advantages of creating unified data and reporting platforms for decision making which will unleash the power of data. While top management must ensure that proper governance framework and accountabilities are set up, various operational teams need to ensure that data governance processes are followed not just from the point of view of compliance, but for more efficient and transparent decision making.

-

Broad Guidelines for a Data Strategy:

-

-

Industry Guidelines for Data Maturity