Menu

-

Context/Background

SBI GI one of the largest general insurance organizations in India, needed a single view of its customer base in order to drive personalized and contextual customer journeys. Since marketing’s data resided in multiple systems within the ecosystem, it oftencreated data silos. This resulted in longer time to marry analytical insights with customer data & drive marketing campaigns; in some cases, it took >20 days. An important aspect of this entire initiative was to create an architecture that enabled to loopback data from across channels, making journey orchestration across traditional & digital channels, manageable.

Problem Statement

SBI GI was faced with the following challenges: • Data Silos:They needed to build a true Customer 360 view across policy lifecycle, channels, product & process • Orchestration Silos:Multiple different orchestration platforms were in use • SBI GI needed to maximize customer lifetime value by improving renewals & product holding rates Objective/Goal

SBI GI’s objective was to build a solution that could provide them with an Omnichannel Customer Lifecycle Management (CLM) to boost revenue & impact customer experience.

This solution needed to be capable of providing:

• A single view of the customer since marketing’s data was residing in multiple systems within the ecosystem, creating data silos. • Shorter time frames to marry analytical insights with customer data & drive marketing campaigns; their systems in use operated at longer time frames in some cases, it took >20 days. • A platform that could easily loopback data from across channels, making journey orchestration across traditional & digital channels manageable. • Complete visibility in the end-to-end marketing process that impacted business operational efficiency for the CLM team. -

Solution

SBI General Insurance was facing two major challenges that were limiting customer lifetime value and reducing opportunities to cross-sell/up-sell: Data Silos and Orchestration Silos.

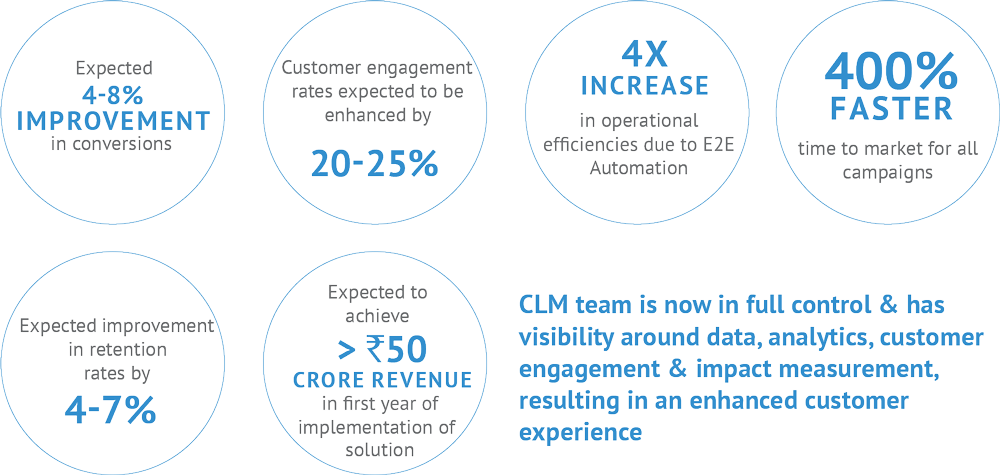

The initiative was to focus on improving customer lifetime value by boosting cross-sell/up-sell and optimally managing customer engagement to improve retention/persistency.

As a part of the initiative, the key solution in play was to build an Enterprise Customer Engagement Hub. It was decided to build this hub on SAS CI360 suite to enable the insurer to offer personalized customer experience across its channel ecosystem. The end-to-end solution is unique in its ability to stitch on-premise transactional data, analytical/

behavioural insight & real-time interaction data on digital properties to personalize the conversation between the insurer & customer.

The key building block was of course data: Unifying it from multiple sources to build a Customer 360 view, and running AI/ML models on top of this data, to identify customer preferences, personas and to deliver the right message to each customer at the right time.

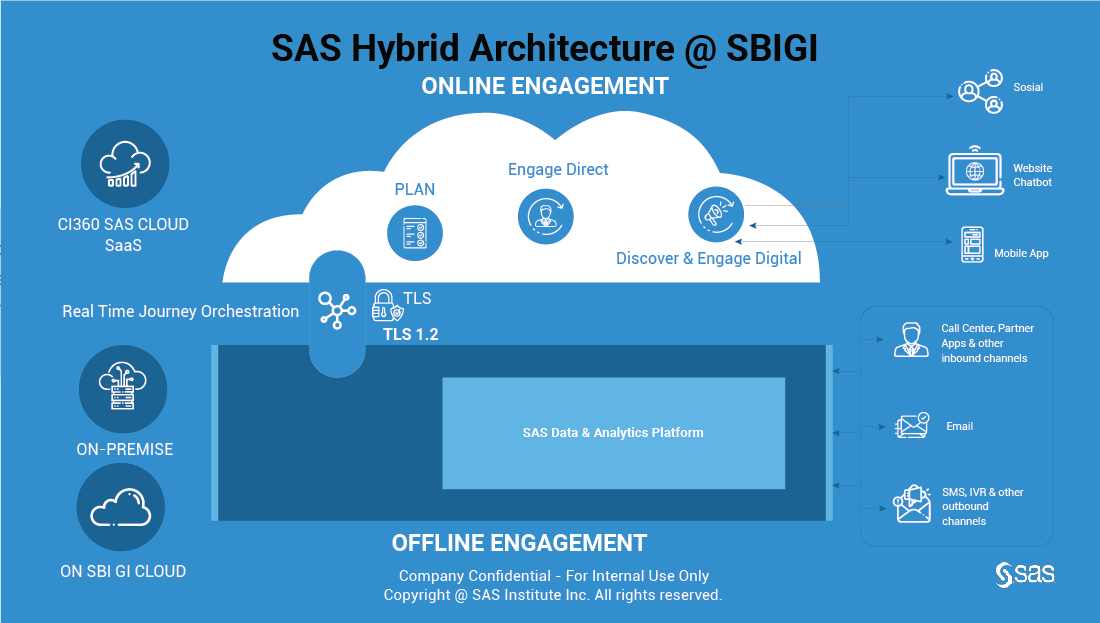

Being an FSI organization, there was immense focus on adopting a solution that adheres to data localization and other security requirements. The SAS CI360 solution was chosen since it offered a hybrid architecture: SBI General Insurance could host all of its data on-premises & still leverage the power of SaaS offering from SAS to execute marketing engagements/ journeys at scale to achieve business goals of retention, persistence, cross-sell & up-sell.

-

Execution

SBI GI followed the best practices for customer centricity by synergizing strategies across data, analytics & engagement capabilities: • SAS’ unique hybrid architecture allows data storage within SBI GI premises as well as on SAS CI360 software, hosted in AWS Mumbai (India), thus helping resolve data residency mandate. • Leveraging SAS analytics capabilities on top of customer-one-view built by the solution, SBI GI could infuse intelligence in business processes. • SAS provided end-to-end managed services to deliver outcome-based value for the CLM team. The solution enabled the CLM team with real-time orchestration of campaigns & journeys across different touchpoints.